- Responding to the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)

- Governance Related to Climate Change

- Impact of Climate-Related Risks and Opportunities on Business

- Climate Change Scenario Analysis and Resilience of the Organization’s Strategy

- Climate Change-Related Risk Management

- Climate-Related Metrics and Targets

As an energy company, we are aware of our responsibilities to help provide safety and security in people’s daily lives while also protecting the global environment. Accordingly, the Group Management Vision declares, “In striving for harmony and symbiosis between our planet, man and society, we aim for sustainable growth towards a future of limitless possibilities.”

In recent years, there has been a growing sense of crisis concerning climate change, with extreme weather events occurring more frequently around the world, along with visible degradation of the natural environment. As a result, the movement to decarbonize is gaining speed worldwide, and governments in Japan and elsewhere have pledged to reach complete carbon neutrality by 2050.

At the Cosmo Energy Group, we also recognize the need to devise and implement business plans that do more to address climate change, in order to help promote the sustainable development of the planet, society, and the Group. This is why we issued our 2050 Net Zero Carbon Declaration, and in May 2022, established our Roadmap for Achieving Net Zero Carbon by 2050. In May 2023, we revised the roadmap to include the entire supply chain.

Roadmap for Achieving Net Zero Carbon by 2050

Having identified climate change countermeasures as one of the Group’s most important material issues, we responded by formulating our Roadmap for Achieving Net Zero Carbon by 2050. We conducted TCFD scenario analysis and analyzed the external and internal environments, reflecting the results in the roadmap.

We will promote our Consolidated Medium-Term Management Plan and update the long-term our vision for climate change countermeasures, the priority material issue, which is a state in which greenhouse gas (GHG) emissions are being properly managed and progress is being made toward achieving net zero carbon emissions by 2050, and the KPI targets for realizing our vison.

Responding to the Recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)

In December 2020, we announced our support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). Based on this framework, we have organized our approach to climate change using the four different recommended areas: governance, strategy, risk management, and metrics and targets. This will help us maintain good communication with a wide range of stakeholders, including shareholders and investors.

In order to accelerate our efforts to address climate change, we have established specific initiatives for all four areas, and we are continually working to improve these efforts.

Governance Related to Climate Change

In order to achieve the “sustainable growth” set out in the Group Management Vision, we treat climate change and other global environmental issues as priority issues. Furthermore, our aim is to be an energy group that helps to alleviate climate change, practicing “harmony and symbiosis with the global environment,” which is part of our Basic Concept of Sustainability. For this reason, Chapter 4 of the Cosmo Energy Group Code of Conduct, which is entitled, “We take care of the global environment,” states that we will proactively and continuously work to preserve the global environment. We also have an Environmental Policy in place to ensure that all of our business activities are conducted in harmony with the environment.

System for Monitoring (Oversight) by the Board of Directors and Role of Senior Management

Governance on climate change has been incorporated into governance on sustainability strategies.

Please refer to the link below for more information on the matters deliberated on by the Sustainability Strategy Council and the reports to the Board of Directors.

Sustainability Management Promotion System

The Sustainability Strategy Council deliberates on matters concerning important operations and policies, including climate change-related issues. Matters deemed to have a major impact on the entire Group are discussed and reported to the Executive Officers’ Committee and the Board of Directors, thereby ensuring appropriate oversight by the senior management team.

As part of the agenda related to climate change, we deliberate and decide on policies for addressing climate change, including the review of the Roadmap for Achieving Net Zero Carbon by 2050, and plans and targets for GHG reductions. We also implement environmental conservation activities (risk reduction measures) to minimize the environmental impact resulting from the business activities of the entire Group and identify business opportunities.

In fiscal 2024, we examined the quantitative financial impact assessment results from the climate change scenario analysis, deliberating on and deciding the quantitative information disclosure of financial impact risks and responses to Green Transformation (GX) promotion strategies. Additionally, as part of our initiative for climate change countermeasures, we conducted semi-annual monitoring of the progress of CO2 emission reduction measures, and reports were submitted to the Board of Directors.

Matters discussed and decided on at the Sustainability Strategy Council meetings are shared by members with their respective departments as necessary, while the secretariat communicates with and delivers reports to the Group companies at the Sustainability Liaison Committee meetings.

Impact of Climate-Related Risks and Opportunities on Business

In order to help build a world of net zero carbon emissions by 2050, the Group has identified important ESG issues (material issues) that have a substantial impact on the sustainable development of society and the Group, as well as on its medium and long-term corporate value. We have identified the following material issues related to climate change “climate change countermeasures,” “provision of clean energy, products, and services,” and “structural reform of profitmaking businesses” in the category of “material issues for sustainable value creation,” as well as “strengthening of Group risk management” in the category of “material issues that form the foundation of business continuity.”

As indicators for measuring progress in addressing these material issues, we have established targets for expanding our renewable energy businesses and reducing GHG emissions. We are also working hard on climate change countermeasures while incorporating the perspective of climate change-related risks and opportunities.

Short-, Medium- and Long-Term Climate-Related Risks and Opportunities and Their Impact on Business

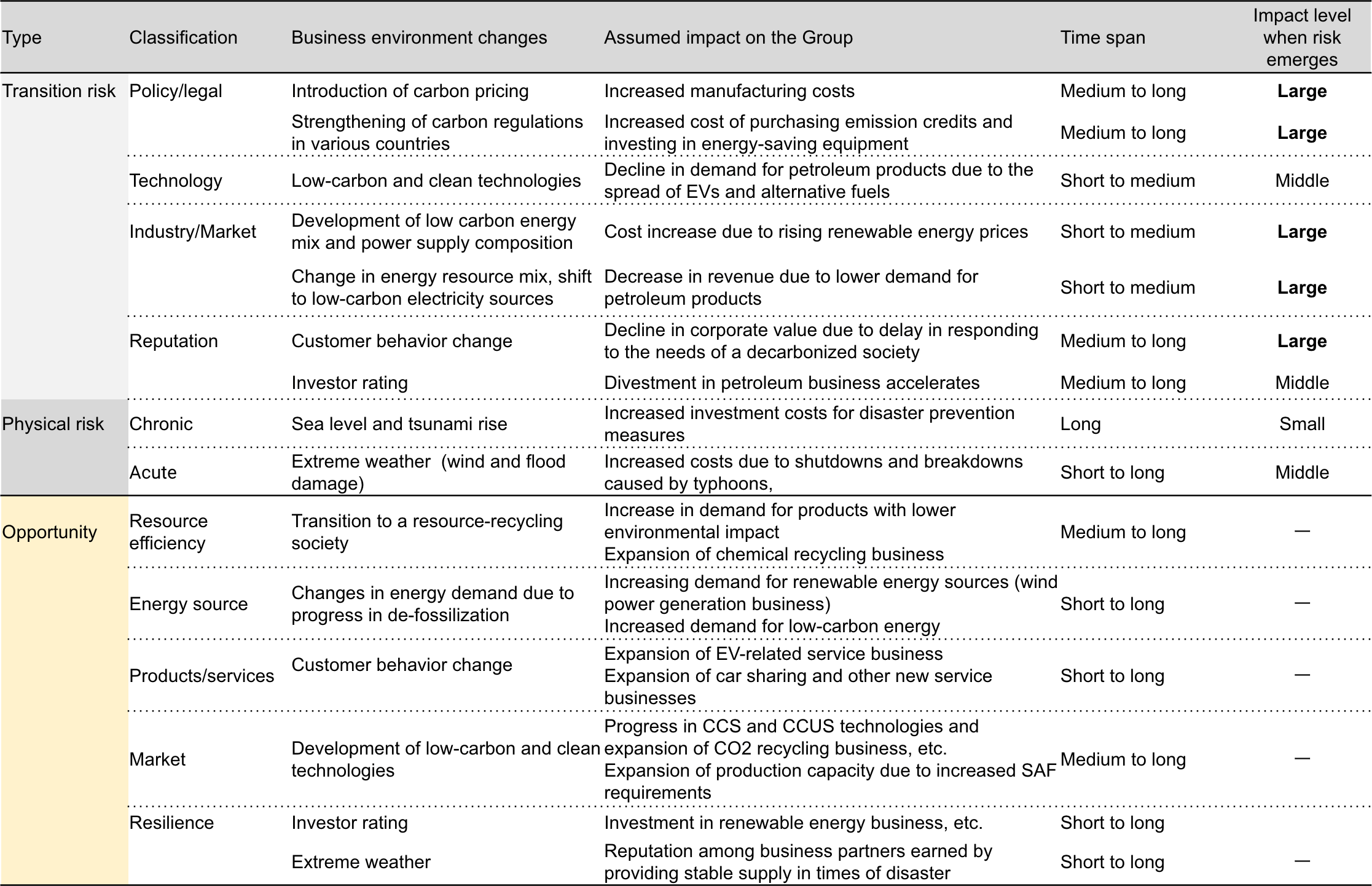

Based on the climate change risks indicated in the TCFD recommendations, the Group investigates the significance of potential climate-related risks and opportunities relating to its business activities. To do this, it identifies potential changes in the business environment as a result of global environmental changes.

The following is a list of the major risks and their impacts, as well as opportunities, as identified by the Group.

Scope: Petroleum development, refining/sales, electric power (renewable energy, IPP), petrochemicals

Time span Short-term= within 1 year, medium term= within 1 to 5 years, long-term= 5 to 20 years

Impact level when risk emerges: Small=Less than 1 billion yen; medium=1 billion yen or more but less than 10 billion yen; large=10 billion yen or more

Climate Change Scenario Analysis and Resilience of the Organization’s Strategy

■ Climate change scenario selection

TCFD recommends that risks and opportunities be assessed based on scenarios under multiple temperature ranges, including the scenario of global warming limited to 2 °C or less. The Group performed the scenario analysis for its petroleum, petrochemical, and oil exploration and production businesses, looking at possible business impacts by 2030, 2040, and 2050.

Two temperature ranges for climate change scenarios were used: the 4 °C scenario (business as usual) and the 1.5 °C scenario (very low-carbon transition). In terms of what the world may look like under these temperature ranges, the Group selected the NZE and APS scenarios of the International Energy Agency (IEA) for the 1.5 °C scenario and the STEPS scenario for the 4 °C scenario, which are used by many companies internationally. We also referred to IPCC RCP8.5, RCP6.0, and RCP2.6 as well as scenarios of Japanese and foreign governments and other sources to take into account physical risks such as natural disasters, which are not included in the IEA scenario.

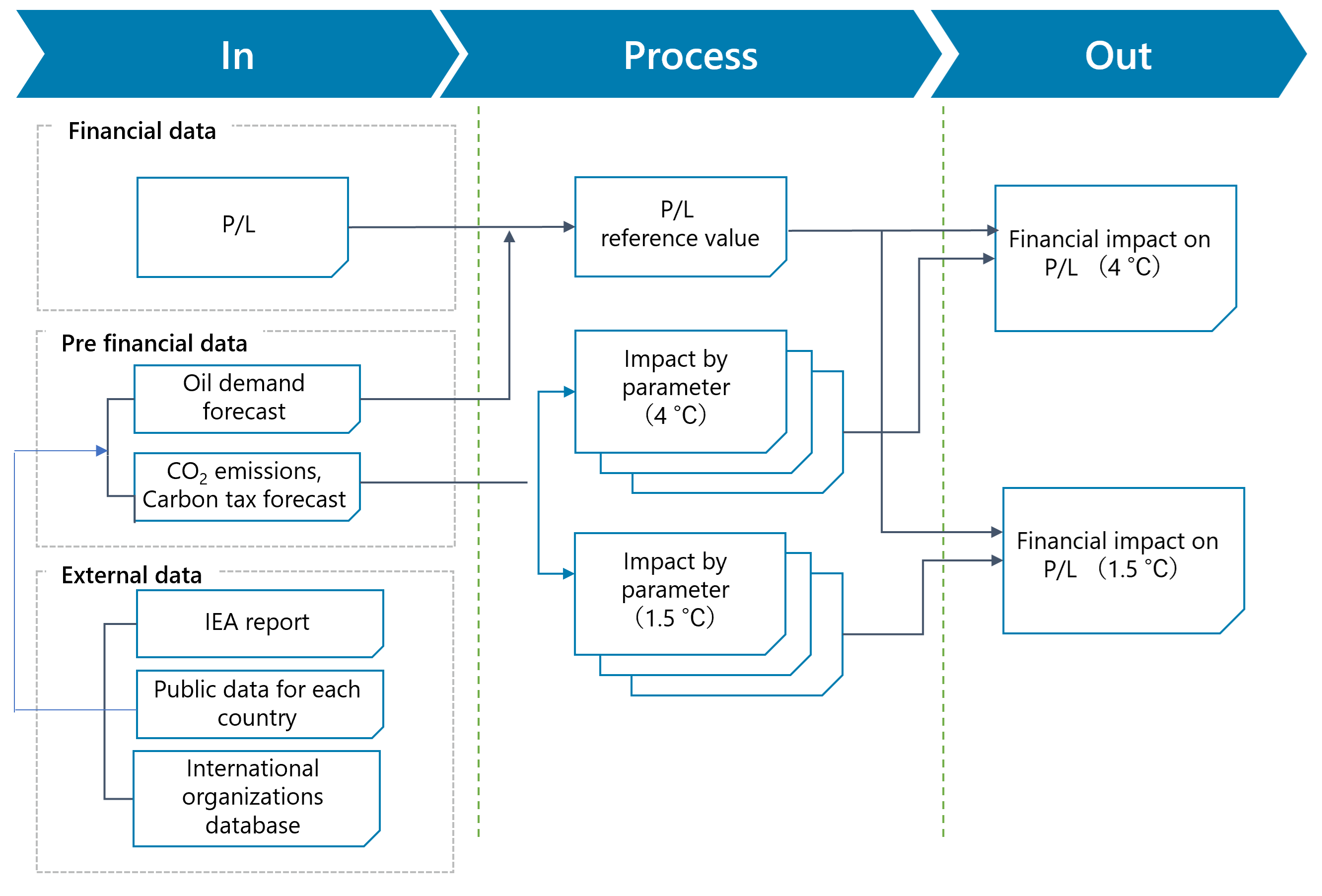

For the scenario analysis, we used demand for petroleum products, carbon prices, disaster incidence rates, and other important parameters that affect our business, and we evaluated the financial impact of each scenario in 2030, 2040, and 2050.

The following shows the analysis process.

The analysis results for the two scenarios assumed are as follows.

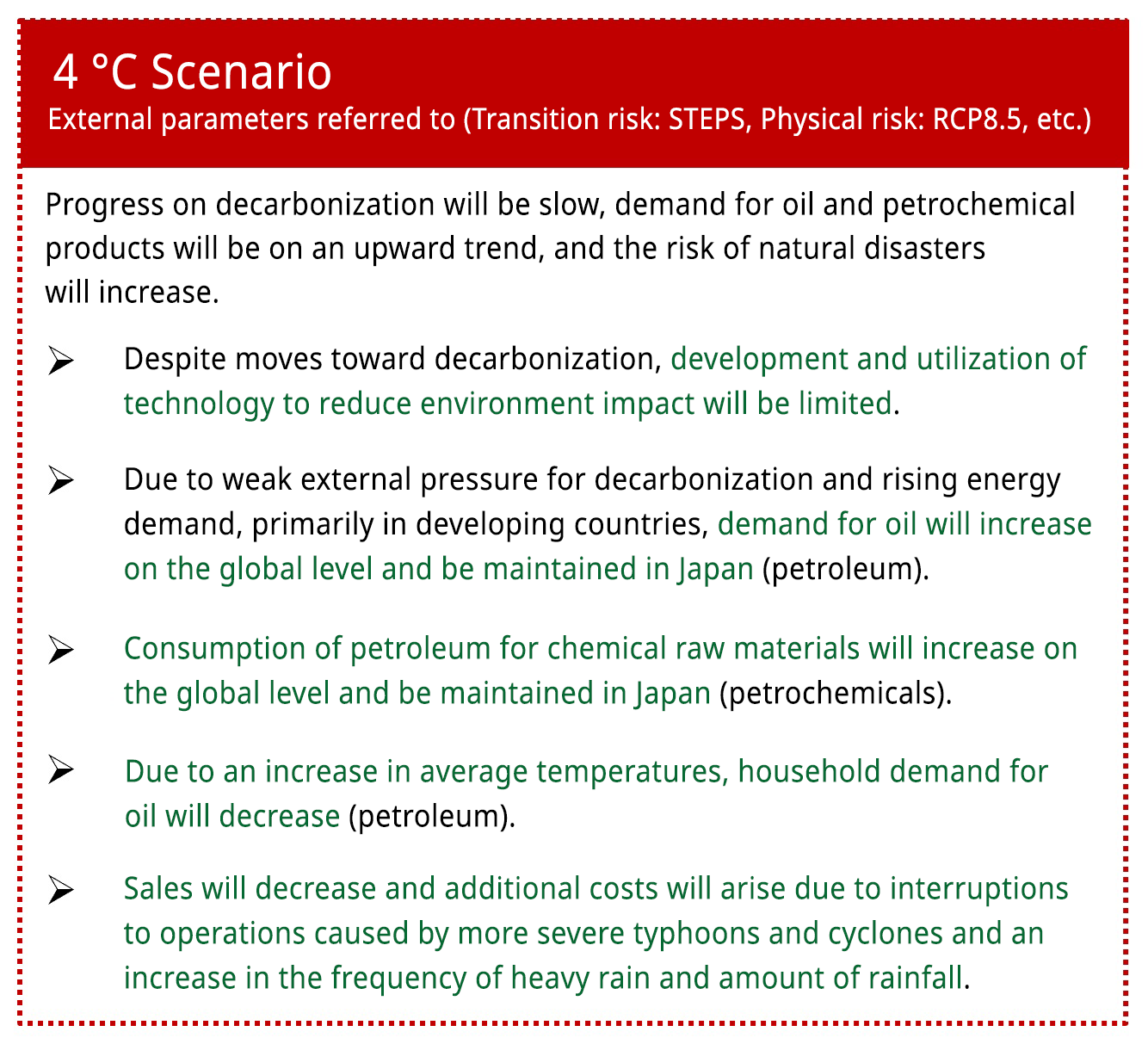

What the world may look like under the 4 °C scenario

With the 4 °C scenario, while the oil business is expected to expand globally, extreme weather events due to climate change will become more frequent and severe. Business losses are expected due to machinery and equipment failure caused by wind and flood damage, along with increased costs in the form of higher insurance premiums.

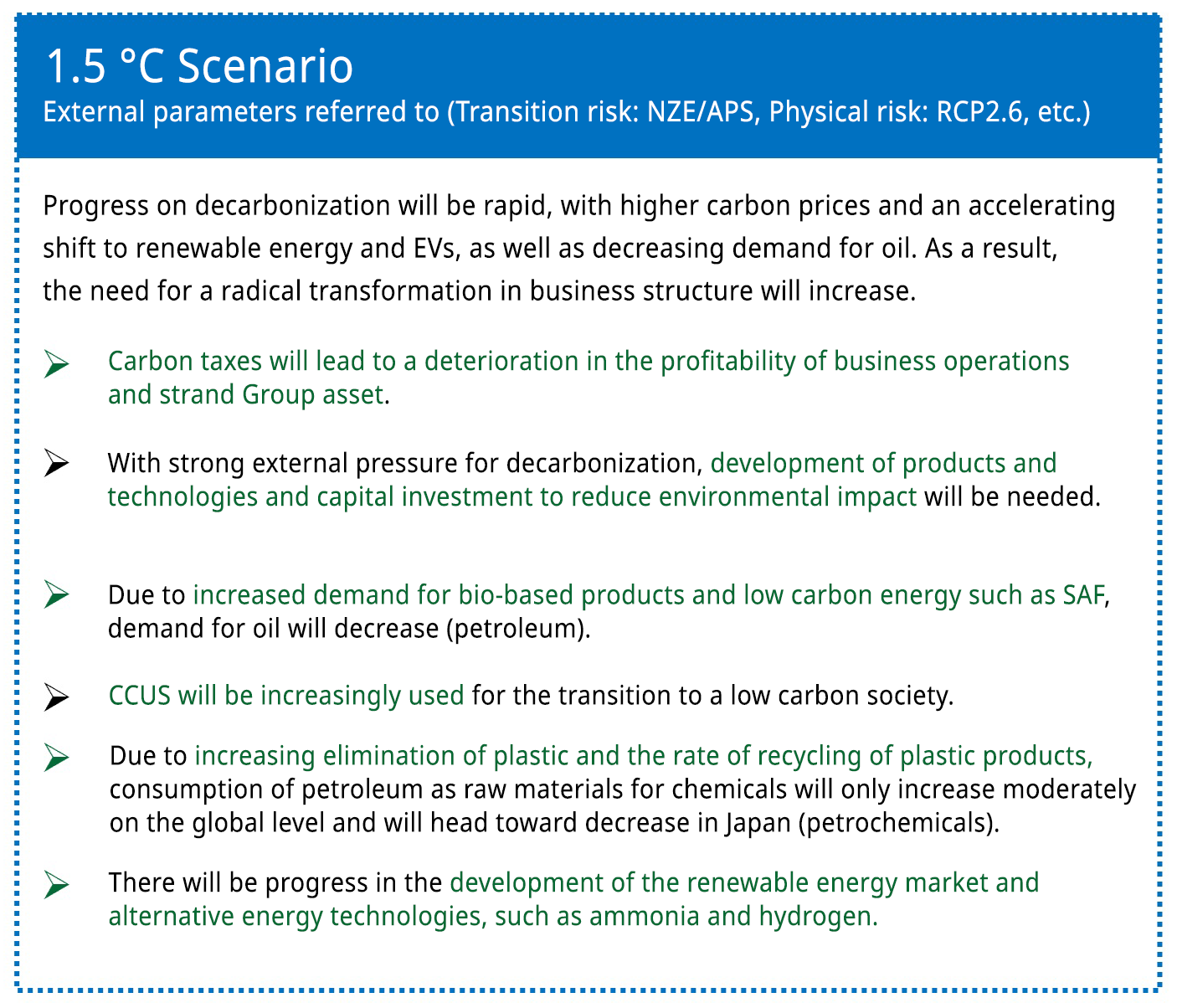

What the world may look like under the 1.5 °C scenario

Under the 1.5 °C scenario, progress on decarbonization will be significant, and declining demand for oil is expected to accelerate as carbon pricing and emissions trading costs increase. It was recognized that there will be an increasing need to reduce emissions in business operations and review portfolios. It was also recognized that maintaining a competitive advantage in the renewable energy and electricity business could provide opportunities to increase sales. Energy companies will be transforming their business portfolios, requiring further development of solar, wind, hydro and other renewable energy markets.

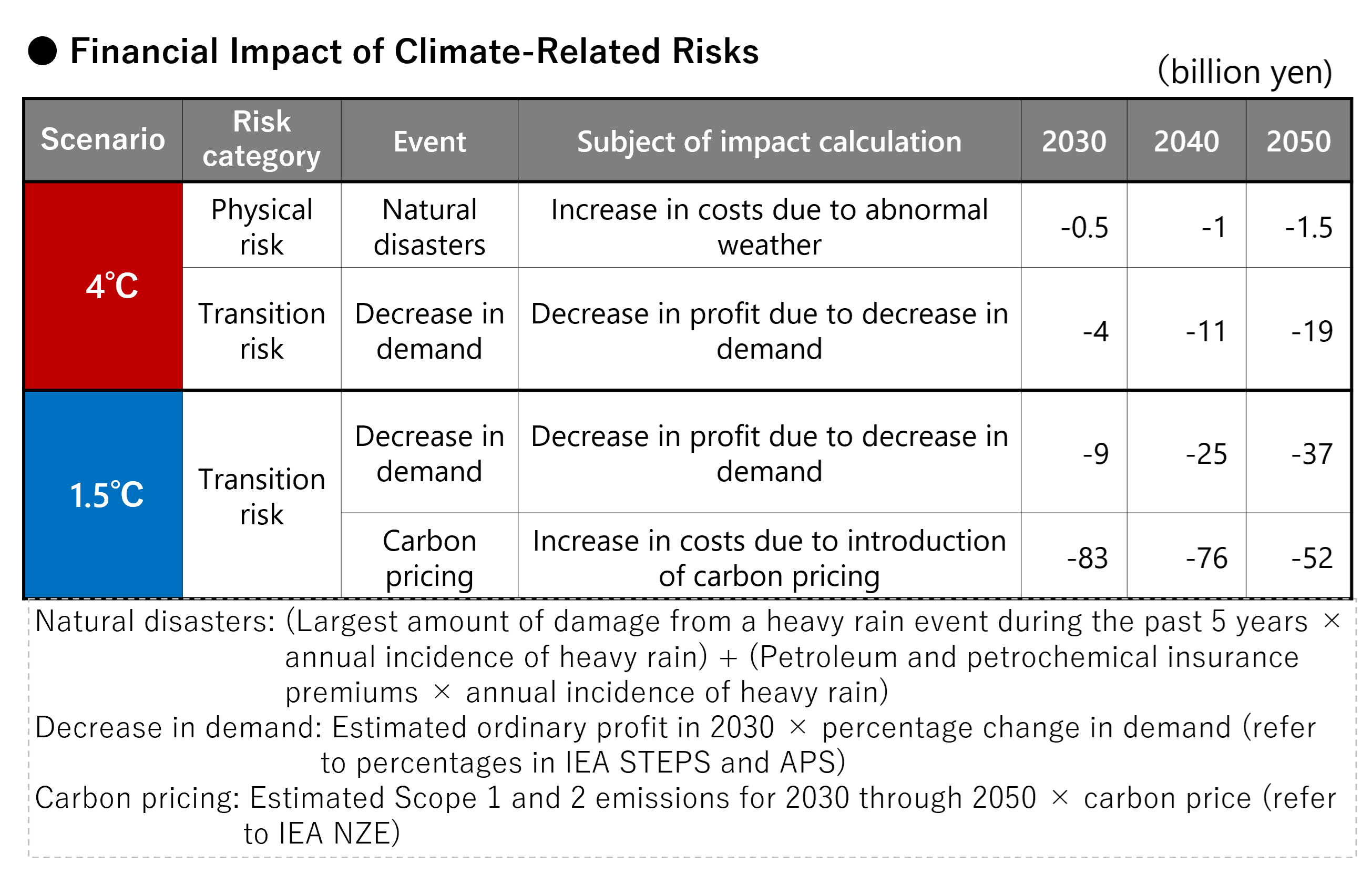

Financial Impact Assessment for Climate Change Scenarios

Based on scenario analysis, we assessed the financial impact under the 4 °C and the 1.5 °C scenarios. The results of our calculations based on the assumptions below are as follows.

For the 4 °C scenario, we calculated estimates for physical risk due to natural disasters and transition risk due decreasing demand based on what the world may look like under the 4 °C scenario. For the 1.5 °C scenario, we calculated estimates for the transition risks of decreasing demand and carbon pricing based on what the world may look like under the 1.5 °C scenario.

Measures to Address Major Risks and Capture Opportunities

The results of the scenario analysis were discussed by the Sustainability Strategy Council, with a review of the Roadmap for Achieving Net Zero Carbon by 2050 and the creation of a system to integrate climate change countermeasures into our management strategies being reflected in the Seventh Consolidated Medium-Term Management Plan.

For these scenario analyses, we targeted our mainstay petroleum, petrochemical, and oil exploration and production businesses, and we conducted a financial impact assessment using a 2030, 2040, and 2050 timeframe.

In Vision 2030, the Company set out to bolster the green electricity supply chain and expand next-generation energy as opportunities for addressing climate change risks. In formulating our long-term vision for the future and other business plans, we will expand investment in the “New” areas under the medium-term plan, with a focus on the green electricity supply chain and next-generation energy, and strive to increase the impact of opportunities. We will perform reviews reflecting our analysis by referring to the latest scenarios and the earnings outlook for opportunities. We will continue to enhance our system, ensuring that is integrated with our management strategy, while promoting disclosure in accordance with TCFD recommendations. This includes regular results reporting to the Sustainability Strategy Council.

Climate Change-Related Risk Management

Identification, Assessment, and Management Processes, and Comprehensive Risk Management

The Group has positioned “strengthening of Group risk management” as one of its material issues. It has established a system to identify all potential risks relating to business activities, appropriately manage various risks, and minimize losses. We are striving to enhance risk management using a cycle of planning, implementation, evaluation, and corrective action.

Refer to Risk Management for more information on risk management at the Cosmo Energy Group.

We regard risks related to climate change as important Group-wide management issues. We have established a system to promote ongoing discussion of this important management issue by the Sustainability Strategy Council, and we are conducting activities such as ascertaining risks and evaluating the progress of response measures.

Climate-Related Metrics and Targets

To achieve net zero carbon emissions by 2050, the Group has established a policy on reducing GHG emissions from its business operations (Scope 1+2), including avoided emissions, by 30% in 2030 (compared to fiscal 2013) and net zero carbon emissions, including Scope 3, to contribute to carbon neutrality for society as a whole by 2050. We are examining initiatives to reduce GHG emissions and achieve these goals.

Risk/Opportunity Metrics

The Group addresses climate change-related risks under a material issue of “climate change countermeasures,” while climate change-related opportunities are managed under material issues of “provision of clean energy, products, and services,” and “structural reform of profitmaking businesses.” We have set metrics and targets for each and are managing progress accordingly.

Please refer to “Fiscal 2024 KPI Targets and Results for Material Issues” on the Sustainability Management Initiatives page for targets and results for climate change-related risks and opportunities.

Scopes 1, 2 and 3 GHG Emissions

The Group has made reducing GHG emissions a top priority in tackling climate change-related risks.

In fiscal 2024, Scope 1 GHG emissions from the Group’s business activities were 6,176,000 t-CO2 and Scope 2 emissions were 256,000 t-CO2, for a total of 6,432,000 t-CO2 for Scopes 1 and 2 combined (down 10% year on year).

The reduction in Scopes 1 and 2 emissions was 689,000 t-CO2 from the previous fiscal year (1,632,000 tCO2 from fiscal 2013) due to the promotion of energy conservation activities, reductions in capacity utilization, and other measures.

Concerning the 30% GHG emission reduction target for 2030, Scope 1 and 2 emissions, including avoided emissions, totaled 5,964,000 t-CO2, reflecting a 24% reduction compared to fiscal 2013.

| FY2013 | FY2023 | FY2024 | |

|---|---|---|---|

| Scope 1 | 7,744 | 6,895 | 6,176 |

| Scope 2 | 320 | 226 | 256 |

| Scopes 1 and 2 total emissions | 8,064 | 7,121 | 6,432 |

| Biofuel (gasoline containing ETBE) 1 | -74 | -207 | -219 |

| Expansion of wind power 2 | -160 | -276 | -249 |

| Emissions total including avoided emissions | 7,829 | 6,638 | 5,964 |

| Reduction vs. FY2013 | ー | 15% | 24% |

1. Biofuel: The avoided CO2 emissions resulting from adding ETBE to gasoline is calculated as negative CO2 emissions.

2. Expansion of wind power: CO2 emissions avoiding by using renewable energy is calculated as negative CO2 emissions (total power generation for the fiscal year concerned multiplied by the emissions intensity of the displaced fossil fuel-based electricity for the fiscal year concerned).

We expanded the previous scope of tabulation for Scope 3 emissions and tabulated all the relevant categories (1 through 7, 9, and 11 through 13, and 15). The total for Scope 3 emissions was 75,032,000 t-CO2.

Detailed figures on results are available in ESG Data.